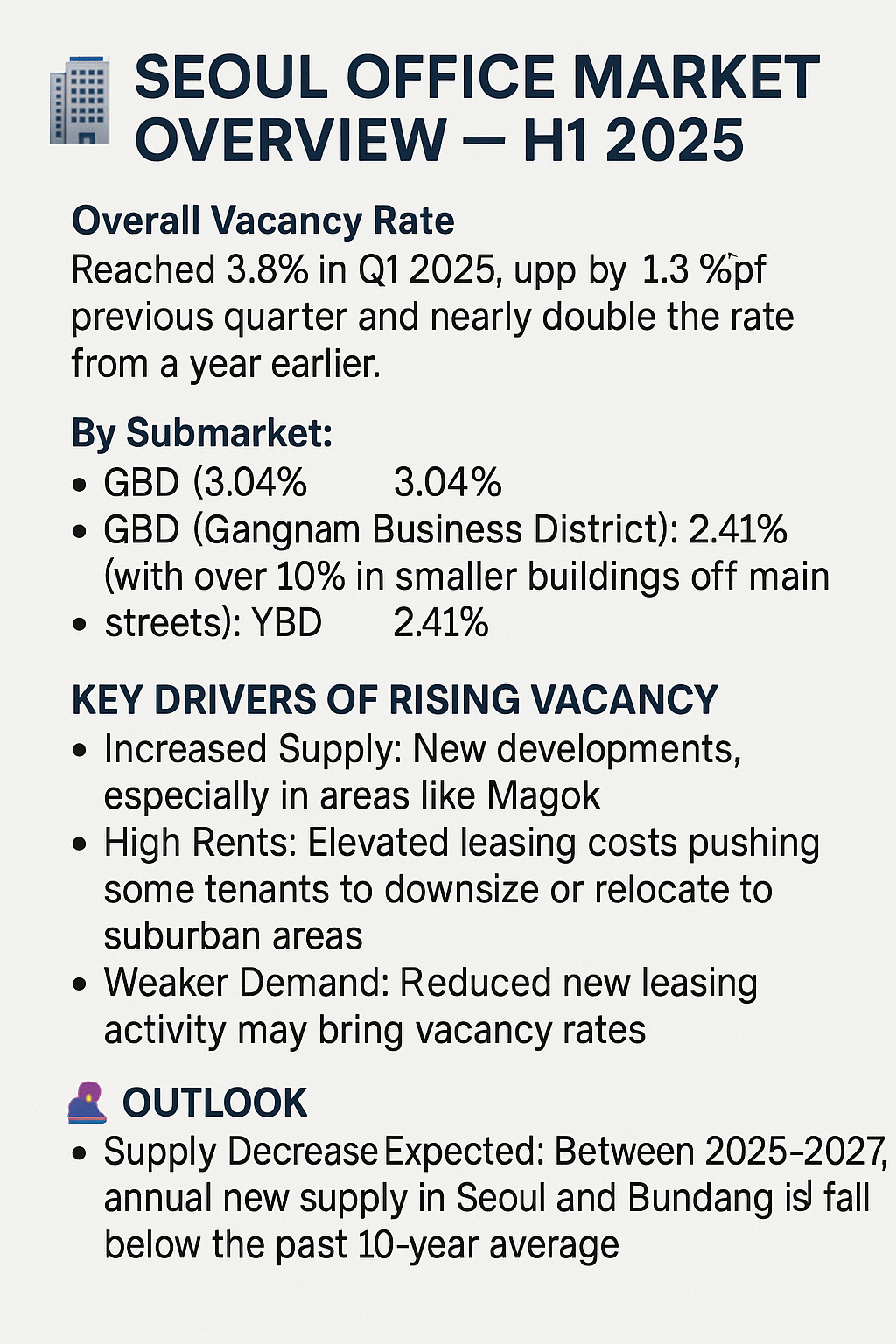

🏢 Seoul Office Market Overview – H1 2025

Overall Vacancy Rate:

- Reached 3.8% in Q1 2025, up by 1.3 percentage points from the previous quarter and nearly double the rate from a year earlier.

By Submarket:

- CBD (Central Business District): 3.04%

- GBD (Gangnam Business District): 3.4% (with over 10% in smaller buildings off main streets)

- YBD (Yeouido Business District): 2.41%

📉 Key Drivers of Rising Vacancy

- Increased Supply: New developments, especially in areas like Magok, added significant new inventory.

- High Rents: Elevated leasing costs are pushing some tenants to downsize or relocate to suburban areas.

- Weaker Demand: Economic slowdown is reducing new leasing activity.

🔮 Outlook

- Supply Decrease Expected: Between 2025 and 2027, annual new supply in Seoul and Bundang is projected to fall below the past 10-year average.

- Vacancy Stabilization: Lower new supply and redevelopment projects may bring vacancy rates down to a stable 3% range.

- Rent Pressures: As vacancy tightens, upward pressure on rents is anticipated.

This suggests a transitional phase where short-term softness may be followed by stabilization and potential rent growth in key areas.

'03_경영, 경제 상식' 카테고리의 다른 글

| SKT 유심 정보 유출의 심각성 (2) | 2025.04.28 |

|---|---|

| 중국의 미국 자산 철수 요약 (0) | 2025.04.22 |

| 제주은행이 추진하는 디지털은행은 기존 인터넷은행과 어떤 점이 다른가 (1) | 2025.04.21 |

| 주식 증권 대체 출고 (0) | 2021.03.05 |

| 법인 주소 이전 등기 직접 하기 (0) | 2018.04.24 |

| 비싼 자동차라고 보험료가 비싸지는 않는다 (0) | 2017.03.17 |